Are you tired of being held back by a poor credit score? Let Debt Reduction Services/Moneyfit help you take control with our Credit Report Repair Analysis! We will educate and help you to repair your credit report.

-

Our in-depth analysis of your credit report comes complete with a personalized action plan designed to help you achieve your financial goals.

-

With our analysis, you’ll not only get your FICO score, but also a detailed breakdown of everything in your credit report, along with a customized plan to help you raise your credit score.

-

And if you spot any inaccurate information in your report, our expert team can guild you on how to dispute it and get back on the path to financial success.

Don’t let a lackluster credit score hold you back any longer – sign up for our Credit Report Repair Analysis today and take the first step towards a brighter financial future!

Get Your Credit Report Review

By clicking “Submit” I consent to receive calls and email message offers/information from Debt Reduction Services, Inc. using an autodialer/pre-recorded message at the number I provided. I understand that msg/data rates may apply and that my consent to such communications is not a requirement for purchase. If you would like to stop receiving text messages from DRS, simply reply to a received text with the word STOP.

Call Now to Speak with a Certified Debt Relief Counselor

Just a Few of the Creditors We Can Negotiate with On Your Behalf

Debt Reduction Services’s program is not a loan that replaces your existing debts with a new one. We’re here to act as your advocate and negotiate with your creditors on your behalf.

At Debt Reduction Services, our goal is to provide education and information to help you find the best solution for handling your debts.

What is a Credit Report Repair Analysis?

If you’re looking to make a big purchase like a house or car, or apply for a credit card, you know that a great credit score can make all the difference.

With Debt Reduction Services/Moneyfit’s Credit Report Repair Analysis, you can get the insights you need to make that happen!

Our expert counselors will perform a thorough analysis of your credit report, breaking down each account and explaining how it contributes to your score. With this knowledge in hand, you’ll be empowered to take control of your credit score and get the best rates and products available. You will learn how to repair your credit yourself, with our guidance.

With our standard low fee, based on your state, this educational service is an affordable investment in your financial future. Plus, we understand that finances can be tough, which is why we offer fee waivers or reductions based on your household income. Don’t let a lack of credit knowledge hold you back – sign up for our Credit Report Review today and get on the path to financial success!

What Is the Difference Between the Credit Report Repair Analysis and Credit Repair?

At Debt Reduction Services/Moneyfit, we believe that the best way to improve your credit is through education and empowerment – and that’s exactly what our Credit Analysis service provides. Our analysis is designed to help you take control of your credit, giving you the knowledge and tools, you need to improve your score over the long term.

At Debt Reduction Services/Moneyfit, we believe that the best way to improve your credit is through education and empowerment – and that’s exactly what our Credit Analysis service provides. Our analysis is designed to help you take control of your credit, giving you the knowledge and tools, you need to improve your score over the long term.

In contrast, many credit repair companies offer quick fixes that may not be ethical or effective. Instead of attempting to truly fix credit issues, these companies often rely on temporary band-aids that can actually do more harm than good in the long run. Credit Repair companies typically charge you monthly. There is nothing a credit repair service can do that you cannot do yourself.

At Reduction Services/Moneyfit we give you the tools and resources you need to truly take control of your credit and achieve financial success. So, if you’re ready to learn more about your credit and take the first step towards a brighter financial future, sign up for our Credit Analysis service today!

These are the states that we currently offer this service: AK, AL, AR, CT, DC, HI, LA, MA, MD, MI, MS, NM, NV, OK, PA, RI, SC, SD, TN, TX, UT, WV, and WY.

How do I boost my FICO score FAST?

If you’re looking to give your FICO score a quick boost, there are a few key steps you can take.

First and foremost, make sure you’re paying down your credit balances to below 30 percent of your credit limit – ideally, you want to aim for 10 percent or less. This will help improve your Balance & Limit ratio, which accounts for 30 percent of your credit score. By utilizing as little of your available credit as possible, you’ll be able to make a big impact on your score in a short amount of time.

But that’s not all – you also need to make sure you’re paying your bills on time! Payment history is the biggest factor in your credit score, accounting for a whopping 35 percent. By making all your payments on time, you can start to see your score rise in just a few months. And if you keep it up for around 6 months, you could find yourself in a very good credit score position.

So, if you’re ready to take your credit score to the next level, start with these simple steps and watch your score soar!

How is the FICO credit score determined?

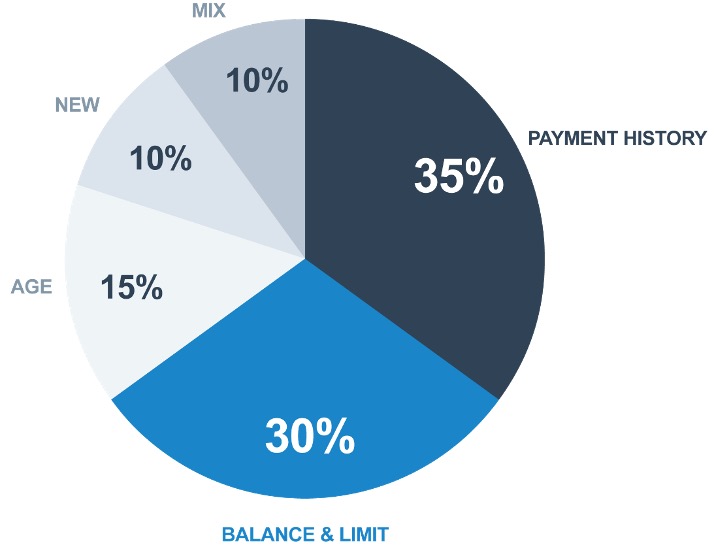

The FICO score is determined by calculating the following:

- Your payment history 35%

- Your Balance and Limit 30%

- Your Length of credit history 15%

- Any New credit 10%

- A Credit Mix 10%

When it comes to understanding your credit score, it’s important to consider a few key factors – including your:

Payment History

Make each monthly payment before the due date. Doing this for as little as three months will start to rebuild your credit score.

Balance and Limit ratio

Your Balance and Limit ratio is the amount you owe on each account in relation to the available credit. It’s crucial to keep this ratio as low as possible, ideally below 30% of the available credit. Even if you pay your bill in full each month, it’s still a good idea to aim for a low Balance and Limit ratio.

Age of the Accounts

The age of your accounts is also important – closing older accounts can have a negative impact on your credit score, both for your Balance and Limit ratio and the amount of time you’ve had the account.

New Accounts

New accounts and credit inquiries can also impact your score. A hard inquiry is a request for new credit, which can have a negative impact on your score. It’s best to wait for some time before applying for new credit, as the more time that passes, the better your score will be.

Mix Accounts

Finally, while the mix of credit types you have is also calculated, it’s not a key factor for your score. Instead, focus on the more impactful items when rebuilding or boosting your credit score. By keeping these factors in mind, you can take control of your credit and achieve the financial freedom you deserve.

What Is the Difference Between the Credit Report Repair Analysis and Credit Repair?

At Debt Reduction Services/Moneyfit, we believe that the best way to improve your credit is through education and empowerment – and that’s exactly what our Credit Analysis service provides. Our analysis is designed to help you take control of your credit, giving you the knowledge and tools, you need to improve your score over the long term.

In contrast, many credit repair companies offer quick fixes that may not be ethical or effective. Instead of attempting to truly fix credit issues, these companies often rely on temporary band-aids that can actually do more harm than good in the long run. That’s why we focus on education and empowerment!

Debt Reduction Services/ Moneyfit we give you the tools and resources you need to truly take control of your credit and achieve financial success. So, if you’re ready to learn more about your credit and take the first step towards a brighter financial future, sign up for our Credit Analysis service today!

Is there a way to review my credit report for free?

AnnualCreditReport.com will provide a free no strings attached credit report from all three bureaus once per year. You will not receive your FICO score; however, you may review your report for accuracy which is paramount to calculating your score.

How do I dispute inaccurate items and errors on my credit report?

Contact each of the bureaus to launch a dispute:

Equifax

All disputes are handled online by Equifax.

Experian

All disputes are handled online by Experian.

TransUnion

By phone: (800) 916-8800

Mail: TransUnion Disputes

2 Baldwin Place, PO Box 1000

Chester, PA 19000